Should you Sell then Buy? Buy then Sell? Some other mix?

SELL FIRST, THEN BUY? BUY FIRST, THEN SELL? If you're a homeowner thinking about moving, you may be facing a tough question. Should you sell your current home before buying, or buy your next home before selling? There are pros and cons to both aproaches, simlar to the classic Prisoner's Dilemma in

How to Play(and win) The Negotiation Game in Real Estate

How to play(and win) the negotiation game in Real Estate Coming to an agreement about buying or selling a home is a matter of smart negotiation combined with fortunate circumstances! Fortunate circumstances means that factors are working in your favor. For example, if prices are falling in a neighb

7 Cracks That Drain A Home Buyer's Money

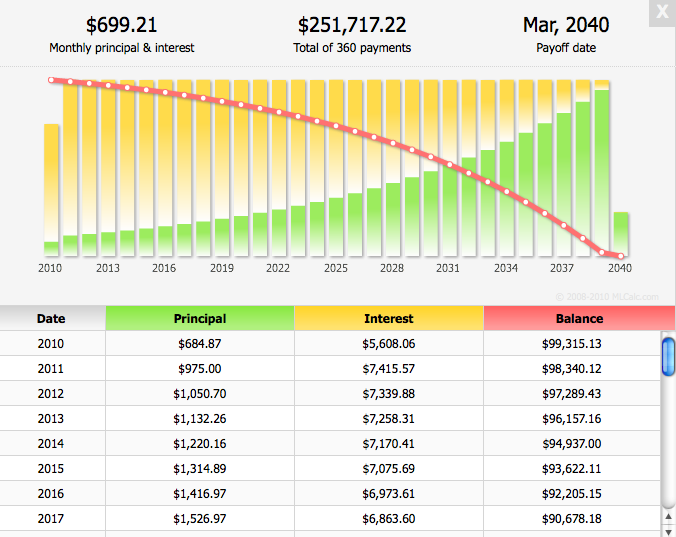

7 CRACKS THAT DRAIN A HOME BUYER’S MONEY A mortgage is the biggest financial commitment most of us will ever make. And when the numbers are that massive, it’s surprisingly easy for thousands of dollars to vanish without you noticing. Before you sign on the dotted line, watch out for these 7 sneaky

Recent Posts