Want to retire earlier?

Want to Retire Earlier? Here’s How to Pay Off Your Mortgage Sooner.

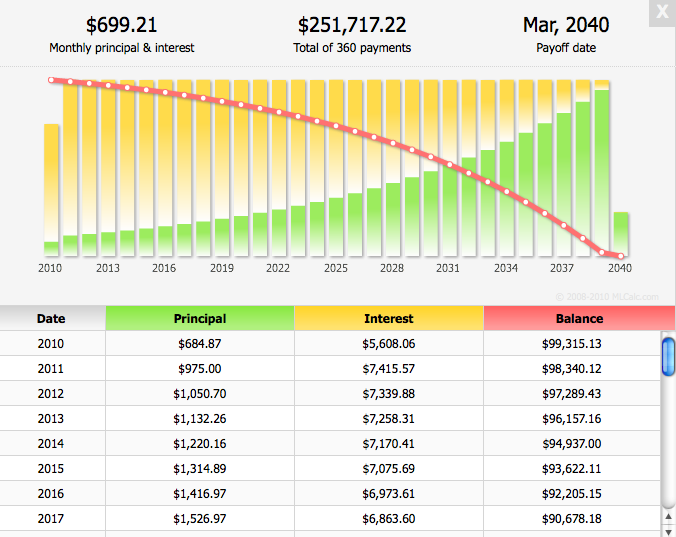

For most people, a mortgage is the biggest monthly bill they’ll ever have—and the one they’ll pay the longest. But what if you could cut years off your loan and save tens (or even hundreds) of thousands of dollars in interest?

You don’t need to refinance or completely overhaul your finances. A few smart moves can add up fast. And the best part? You stay in control. You choose how aggressive you want to be.

If you could knock 5 years—or more—off your mortgage, that’s 5 more years you’re not writing a check to the bank. That’s 5 more years your money can go toward retirement, travel, investing, or just living on your terms.

Here are five practical ways to pay off your mortgage faster:

1. Add One Extra Payment Per Year (the Simple Way)

Take your regular monthly mortgage payment, divide it by 12, and add that amount to each payment. For example, if your mortgage is $1,200 a month, you’d pay an extra $100 each month. Over time, that’s enough to knock 4–5 years off a 30-year loan—just by rounding up.

2. Make an Extra Payment Each Quarter

Want to go bigger? Make one extra full mortgage payment every 3 months. This approach is simple, especially if you get quarterly bonuses or tax returns. If you stay consistent, you could shave 8–10 years off your loan term. That’s not a typo. One extra payment every 90 days makes a huge dent in your loan’s life and the total interest you pay.

3. Switch to Bi-Weekly Payments

Instead of making one monthly payment, you make half your monthly payment every two weeks. Over the course of a year, that adds up to 13 full payments instead of 12. That extra payment gets applied directly to your principal, helping you build equity faster and pay off the loan earlier—without really feeling the difference in your monthly budget.

4. Round Up Your Monthly Payment

Even if it’s just $25 or $50 more a month, consistently rounding up your payment makes a long-term impact. Think of it as a quiet way to pay down your principal without overthinking it. This strategy works well if you’re just getting started or want something manageable that won’t stress your budget.

5. Apply Windfalls Directly to Your Principal

Got a raise? Tax return? Bonus Instead of spending all of it, put a chunk directly toward your mortgage principal. The earlier you do this in your loan term, the bigger the long-term payoff. Even small one-time principal payments can shorten your loan and save you thousands in interest.

-->

Smart Strategy, Real Results

ou don’t have to throw all your extra money at your mortgage—but if you make just a few of these moves, you’ll gain flexibility, peace of mind, and long-term financial freedom. Every dollar you knock off your loan early is a dollar (plus interest) you’re not paying later.

If you’re curious how these strategies could work with your mortgage, I’m happy to walk through it with you—or connect you with a great local lender who can run the numbers. No pressure, just smart planning.

Please call, text, or email me to set an appointment to discuss what you need to do to decreasethe interest you're paying over the term of your loan.

Call or text me at 260.897.1776 for the quickest response!

Recent Posts