My Top 15 Mega Tips for Home Buyers in 2025 and Beyond.

My Top 15 Mega Tips for Home Buyers in 2025 and Beyond.

Buying a home is a huge process that involves so much more than simply finding a house you can afford. Home buyers today need to create a home-buying plan that incorporates many of these 15 factors.

1. Buy a home as early in life as possible.

Then keep it or only trade it for a financially better situation. The earlier you buy, the better. Having more equity earlier in life is better than the alternative, giving you more opportunity to grow your investments.

2. Make sure your property is well-maintained over the years(buy right).

If you need to sell because you fall onto hard times, or you want to sell because you're ready, or you want to tap your equity without selling, all those things will be possible with a home in good condition. You need to buy right, so that you afford the big expenses of owning a home. Or consider a condo where the condo fee spreads those costs over time as a fixed expense.

3. Buy as soon as you can afford a house, no matter the interest rate.

Waiting for rates to drop only means that others are waiting, too. House prices won't drop in response to lower rates; they'll do the opposite.

4. That's not an easy ask. You have family nearby, you're familiar with the area, maybe you grew up here. But if you are not able to buy here, then consider relocation. Relocation brings new opportunities. You may love where you go, or you may simply bide your time until you can move back. Just remember the break-even point on most home purchases is 5 to 7 years.

5. As an alternative to relocation, consider buying an investment property in a more affordable location.

Consider condos near colleges or small rental homes near large industries. The most important factors are that the rents will cover your mortgage and expenses, and the rental market is consistent. Meanwhile, you can pay rent for the place you live now, knowing that you're "in" the real estate market someplace else.

6. If you can afford it, and if these types of properties are available near you, buy a multi-family property.

Live in one of the units, while renting out the others. Put 20% down, as this gives you the most leverage, ensuring that your renters are paying your portion of the mortgage, allowing you to live "free" while gaining equity. Contact me to see what's available.

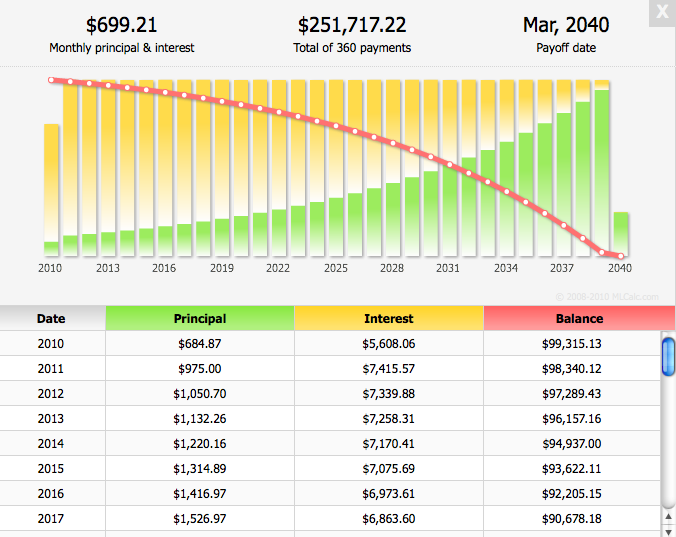

7. Shop for mortgage rates before you buy

Don't get sucked into an online promise of great rates, just because it's convenient. Go to different sources. Include at least these three sources: 1) A mortgage broker that your real estate agent trusts (contact me for some referrals). 2) Your personal bank. 3) Online mortgage companies. Compare fees and interest rates, not just rates. You may not get much difference, but even a quarter-percent might get you $50 to $100 more per month buying power. Just for shopping rates!

8. Ask family to help to by your home or investment.

Consider ways to pay them back or consider it a gift. If you do plan to pay the money back, don't allow it to be formalized as a loan or the bank will consider that a debt. Clearly this involves a level of trust in your family, as well as the funds to make it work. But, if possible, don't be shy about asking. There are other rules for accepting (or giving) a cash gift, so do your research.

9. Put 20% down.

This is an extreme stretch for many people. If you can't do 20%, do 10% or 7% or whatever you can. The reason? That pesky PMI (private mortgage insurance). Unless you're buying a home using a government loan or other alternative loan, you're likely going to pay PMI if you put less than 20% down. That's money wasted, thrown away, never to provide you with any value at all. (Except in rare circumstances. See my analysis of PMI in my November 2024 newsletter. Or ask me for a copy.) PMI insures the mortgage holder, not you.

10. Don't buy more than you can afford, just because you love the house.

Ideally, you should shop below your highest approved price point, based on the quality of life you plan to have. If you know you're going to have kids, you'll want enough money for their many expenses. If you plan to travel a significant amount, you'll want to have more money to put into the experience. If you want to retire early, you'll need to invest more sooner. Don't be house poor!

11. Consider house-hacking.

It's not the strange idea it used to be. Buy a house with a floorplan that allows you to comfortably rent out a room, or add an ADU (accessory dwelling unit, or granny flat). This can considerably lower your monthly expenses, without affecting your quality of life, if you buy the right property. Contact me for help figuring this out.

12. Get online and start hunting for down payment and mortgage assistance programs in your area.

They may or may not exist and you may or may not be eligible. But it might pay to look.

13. Consider an ARM(Adjustable-Rate Mortgage).

As much as 30% of mortgages today are adjustable-rate mortgages, so don't think this is an unusual concept. Many ARMs start with an initial low fixed rate for five to 10 years before rising. So, if you plan to sell in that time frame, an adjustable-rate mortgage might make great sense for you. Note that you must qualify at the fully realized future interest rate, even though you'll pay less on the front end of the mortgage.

14. Count your side income.

If you've been making and selling cookies at the local farmer's market for the past couple years, making an extra $1,000/mo. profit, and you have documented your income and expenses, your lender might be able to count that towards your qualifying amount. Just make sure you're planning to continue that side income to ensure you can afford the home. Alternatively, spend the next year saving your side hustle money for a higher down payment. Remember, the higher the down, the lower your PMI and monthly payment.

15. Be clear about how you'll compensate your real estate agent.

It's hard to buy a home without an agent. It's possible, but for the average home buyer, there are simply too many moving variables and potential pitfalls to "go it alone." That means hiring an agent to help you navigate and negotiate the purchase. Agents can be expensive, so discuss the fee structure with an agent ahead of time, in particular if you're expecting to ask the home seller to pay your agent's fee (which is traditionally how it's been done).

Your Best Next Step

Contact me for help to create your home buying plan that includes all these factors! I’m not just an agent. I’m your real estate-for-life advisor.

Call or text me at 260.897.1776 for fastest service!

Recent Posts