7 Cracks That Drain A Home Buyer's Money

7 CRACKS THAT DRAIN A HOME BUYER’S MONEY

A mortgage is the biggest financial commitment most of us will ever make. And when the numbers are that massive, it’s surprisingly easy for thousands of dollars to vanish without you noticing. Before you sign on the dotted line, watch out for these 7 sneaky money leaks that can drain your wallet over time.

CRACK 1. IGNORING THE TRUE COST OF HOME OWNERSHIP WHEN BUYING

Owning a home comes with ongoing costs that often surprise buyers. Even seasoned homeowners can forget how much it takes to upgrade outdated features or fix hidden issues. It’s smart to consider these costs before you commit to a purchase.

Before you buy, do a realistic estimate of what it’ll cost to bring the home up to your standards. In some cases, paying more for a move-in-ready home may be cheaper in the long run than buying a lower-priced home that needs major upgrades.

On the flip side, if affording a large down payment is a struggle, a less expensive home that needs work could be a smart choice. Your sweat equity—doing the upgrades yourself over time—can offset the lower upfront cost.

For example, a 20% down payment on a $300,000 home is $60,000. If that’s out of reach, a nearby fixer-upper priced at $225,000 would require just $45,000 down. That extra $15,000 could fund key renovations—without needing to come up with it all at once. This can be a great investment if you go in with open eyes—and a solid home inspection.

Ongoing Maintenance

The longer you own a home, the more repairs and improvements you'll need to make. You might eventually need a new roof, driveway repairs, or a fence replacement. Unexpected expenses like tree removal, broken water mains, or termite treatment can add up fast.

As a general rule, set aside 1–2% of your home’s value each year for maintenance. For a $250,000 home, that’s $2,500 to $5,000 annually on less-than-glamorous fixes like water heaters or furnace servicing. It adds up quickly—especially in older or larger homes.

Consider also starting a savings fund for big-ticket items. If your roof has five years left, start saving now.

CRACK 2. BECOMING HOUSE POOR

Your home isn’t the only thing you’ll need to budget for. There’s also your car, retirement savings, college funds, vacations, and even furniture. If your mortgage eats up too much of your income, these other areas can suffer.

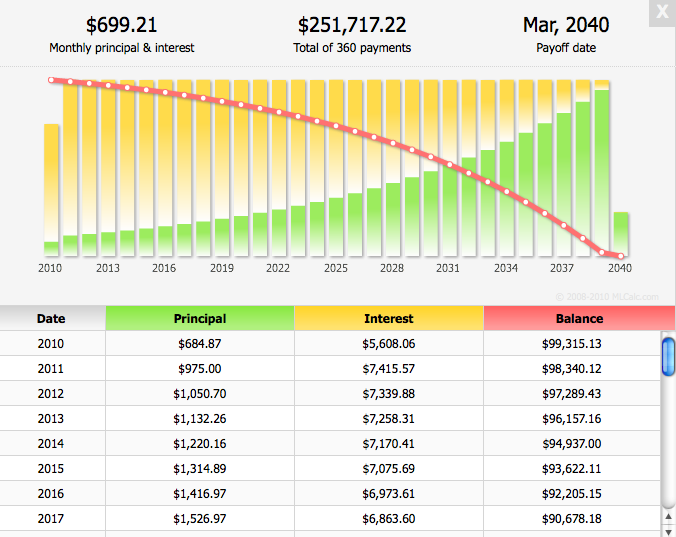

A general guideline is to spend no more than 28% of your gross income on housing. If you earn $75,000 a year, that means about $1,750/month—including mortgage payments, insurance, and association fees. Use a mortgage calculator to find out what price range fits your budget and how much down payment you’ll need.

CRACK 3. NOT SHOPPING AROUND FOR LOANS

It may seem like all mortgage loans are the same, especially if a broker only shows you one option. But you actually have choices—and some loans come with better rates or terms based on your qualifications.

You may even qualify for special programs that offer down payment help, such as teacher incentives or loans for properties in revitalizing areas. Even among standard 30-year fixed loans, interest rates can vary. According to the Consumer Financial Protection Bureau, rates can differ by more than half a percent. A 6.5% loan instead of 6.9% could save you around $80/month—or nearly $5,000 over five years.

Compare rates from at least three sources: a broker, a bank, and a credit union. Each may offer different fees or know of special programs. A little research can save you thousands over the life of your loan.

CRACK 4. IGNORING THE FEES

Some lenders advertise low interest rates but make up for it with high fees—often rolled into your loan. While this reduces your upfront costs, it means you’ll pay interest on those fees for years.

Sometimes a slightly higher interest rate with lower fees results in a better overall deal. That’s where APR (Annual Percentage Rate) comes in—it reflects your interest rate plus fees over the life of the loan.

For example, a 6.65% rate might jump to 6.95% once fees are added. That extra $20/month doesn’t sound like much—until you realize it adds up to $7,200 over 30 years.

Compare fee structures carefully. A lender with lower fees could save you thousands. Unless you plan to sell in a few years, even small differences matter.

CRACK 5. MAKING A SMALL DOWN PAYMENT

To get the best rates and avoid private mortgage insurance (PMI), a 20% down payment is ideal. PMI can add hundreds to your monthly payment—and offers no benefit to you. It goes away once your equity reaches 20%, but until then, it’s an extra cost.

If you can’t hit that 20% mark, consider your options:

- Wait and save more.

- Buy a less expensive home where 20% is more doable.

- If you must buy now, plan to renovate. you may be able to boost your home’s value enough to reach 20% equity. Just be sure to ask the lender when they’ll reassess your home’s value—some won’t for two years, keeping you stuck with PMI longer than expected.

CRACK 6. NOT CHECKING AND FIXING CREDIT REPORTS

Checking your credit report should be part of your regular financial checkup, but it’s especially important before applying for a mortgage. Why? Because your credit score directly impacts your interest rate—and that affects your monthly payments and total cost.

Even small errors on your report can hurt your score. Old issues you’ve already resolved—like a forgotten bill—can linger unfairly. You have the right to dispute and remove them.

Also, be mindful of your credit usage. High usage can make lenders nervous. Try to keep balances low, but don’t close accounts entirely. A healthy mix of credit lines, used wisely, looks better than no credit at all.

Cleaning up your credit can mean better rates and a bigger home-buying budget.

CRACK 7. NOT WAITING UNTIL YOU’RE MORE FINANCIALLY STABLE

Sometimes the best move is to wait. Saving for a 20% down payment can dramatically reduce your mortgage, monthly payments, and PMI costs. Waiting might feel hard—but it often pays off big in the long run.

You’ll also want enough income to comfortably cover maintenance and enjoy life outside your home. A solid financial cushion means you won’t feel squeezed after moving in.

That said, sometimes jumping in does make sense. If home prices are rising quickly, or you find a great deal, buying now—even if it stretches you—could be the right call. Just make sure it’s a decision made with both eyes open.

Contact me for home buyer or seller representation. Let me help you avoid mistakes that could cost you thousands over time.

Give me a call at 260.897.1776 or email me at nate@hicksteamrealestate.com to get coffee scheduled and get started!

Recent Posts