Should you Sell then Buy? Buy then Sell? Some other mix?

SELL FIRST, THEN BUY? BUY FIRST, THEN SELL?

If you're a homeowner thinking about moving, you may be facing a tough question. Should you sell your current home before buying, or buy your next home before selling?

There are pros and cons to both aproaches, simlar to the classic Prisoner's Dilemma in Negotiation Theory. Each path carries risk, but for different reasons. My job is to help you understand those trade-offs so you can make a confident decision.

The Ideal (but rare) Scenario

In a perfect world, you'd sell your current home and close on your next home the same day. The funds from your sale would roll seamlessly into your purchase. Unfortunately, real estate rarely works that cleanly. Timing tends to be off in one direction or the other—you might sell your home before you've found the next one, or fall in love with a home before your current one has sold.

So what’s the best move when you can’t do both at the same time? Let’s walk through the main options.

When you hire an agent, you want someone who knows how to negotiate and get information that helps your position.

Even though the agent is in charge of the negotiation, you should be knowledgeable about negotiation tactics, so you can work with your agent to recognize and use strategies to your advantage. With that goal, here are eight negotiation tactics commonly used in real estate.

Option 1: Sell First, Then Buy

Selling your home first gives you a clear budget and ensures you won’t get stuck with two mortgages. However, it means you’ll need a temporary place to live between closings—possibly for 30 to 60 days. That might mean a short-term rental or staying with friends or family. You’ll also need to store your belongings and move twice, which can add cost and stress.

Still, this option gives you more financial security and bargaining power when you're ready to buy.

Option 2: Buy First, Then Sell (With Two Mortgages Or A Bridge Loan)

If your finances allow, you could purchase your next home before selling your current one. This avoids the hassle of temporary housing and multiple moves. Some buyers use a bridge loan or financing solution that covers both homes temporarily.

If your finances allow, you could purchase your next home before selling your current one. This avoids the hassle of temporary housing and multiple moves. Some buyers use a bridge loan or financing solution that covers both homes temporarily.

Option 3: Make An Aggressive Sale

You could focus on buying first, then list your home at a very competitive price to attract a quick offer. This increases your chances of syncing up both deals.

But you may end up leaving money on the table, especially if you rush to sell. If getting top dollar from your current home is important, this option may not be for you.

Option 4: Make An Offer Contingent On Selling

Another route is to make an offer on a new home that’s contingent on selling your current one. In theory, this allows you to align the two transactions and avoid temporary housing.

However, most sellers are hesitant to accept a contingent offer—especially in a competitive market. After all, would you take your home off the market while waiting for a buyer to sell theirs? Probably not.

Option 5: Sell First, Then Negotiate a Rent-Back

This is often the most flexible and balanced option. Once you get an offer on your home, you can negotiate to stay in the house for 15 to 60 days after closing. This is called a rent-back agreement and gives you time to shop for your next home without having to move twice.

You’re essentially renting your own home for a short period. While that may feel strange, it’s often a smart way to reduce pressure and avoid costly mistakes.

Option 6: Take Your Chances and Time it Right

Some people choose to move forward with both buying and selling at the same time, hoping everything lines up. While it sometimes works, it’s risky. Both buyers and sellers usually have a window—during inspections and loan contingencies—when they can back out. You may be able to walk away from a deal if things don’t line up, but that kind of juggling can be stressful and ethically questionable if used as a strategy.

What I Recommend

Here's how I advise most clients to approach the situation:

-

Talk to your lender early!

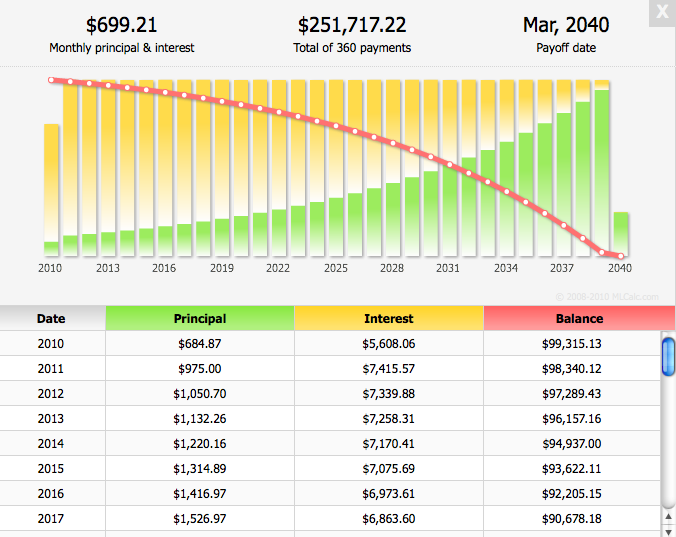

Know what you qualify for. Can you afford two mortgages temporarily? Are there loan options like bridge financing available to you?

-

Understand The Market

Let's look at how quickly homes are selling in your neighborhood and what kind of home you can buy for your budget. Knowing the pace ofthe market helps us decide whether selling first or buying first makes more sense.

-

Have a Backup Plan

Research Temporary housing, storage, and moving costs. You may not need them, but knowing your options ahead of time removes uncertainty.

-

Combine Strategies When Possible

- Start exploring homes in your price range now.

- List your home and plan to ask for a rent-back period when you get an offer.

- Once your home is under contract, and the buyer has agreed to your rent-back terms, you can begin making offers on your next home.

- If your buyer backs out during their contingency period, you can do the same on your purchase.

Final Thoughts

There’s no perfect answer—but with planning and the right strategy, we can minimize stress and maximize your chances of a smooth transition. I’ll be here to help guide every step of the way.

Want planning advice around your next sale, purchase, or both?

Whether you’re buying your dream home, selling your first home, or wanting to make commercial moves, I'd love to guide you and negotiate to your goal!

Please call, text, or email me to set an appointment to discuss when our next steps need to be. Call or text me at 260.897.1776 for fastest service!

Recent Posts