10 Pre-Retirement Mistakes to Avoid

Most of us don’t start thinking about retirement until we’re in our late 50s or early 60s. By then, it might be too late to make changes. Here’s what to start thinking about in your 40’s.

1. Lack of a retirement vision

2. Refusal to change thinking about money

3. Not hiring professional financial help

To find a financial advisor, you can hire a fiduciary financial planner who works as a consultant or coach to go through your financial and retirement strategies with you. Unlike fee-based financial planners who take a fee from investments, a fiduciary advisor is paid directly by you for consultation services. The advisor might have a better grasp of all the financial planning concerns you face, not merely whether your investments will give you the return you want.

4. Failing to establish a formal plan

5. Pulling investments too soon

But if you’re 50 years old and short by $400,000, you can’t play it too safe. Pulling all your money out of the stock market would mean bringing your earnings to a halt, while leaving it in could mean another $400,000 over the next ten years.

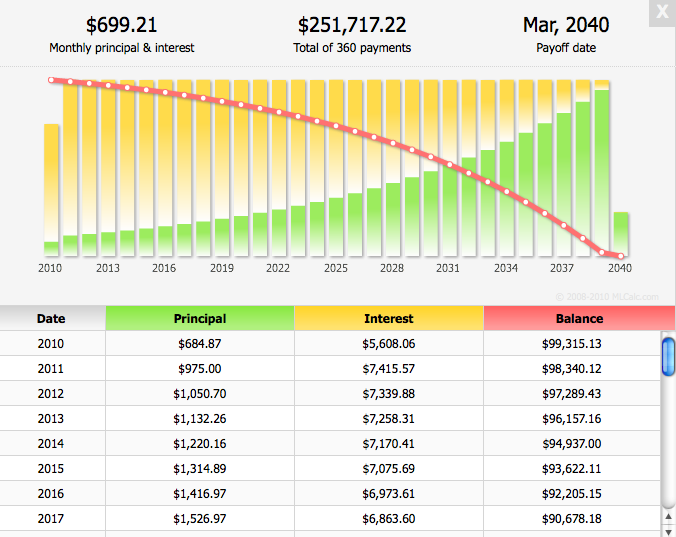

Here’s a good simple compounding interest calculator. https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

6. Not really downsizing

Many pre-retired homeowners think they’ll be able to downsize to save money. But buying a smaller home or renting somewhere less expensive doesn't always equal savings. Often people don't save much as they think they would. For example, if someone sells a $500,000 house, they might spend almost as much purchasing a smaller but nicer new home. Between closing costs [buying and selling], moving and buying new furniture, they may spend about $100,000. That’s money they wouldn’t have spent if they’d stayed put, or truly downsized. Ideally, downsizing means spending as little as possible on the downside move to preserve as much of the equity you can from the sale of your home.

7. Not planning for parents

Many of us in pre-retirement phase of life are only thinking about ourselves, what our vision is and how much we need to support that vision. We forget that we might have elderly mothers and fathers to support. Yet statistics show that only a small percentage of pre-retirees integrate their parents' financial needs into their own comprehensive financial plans. If you have parents to care for, examine their financial situation, too.

8. Not planning enough for healthcare

As we age, we’d like to think we’ll be one of those healthy older people who still jog or manage to outlive the odds. But our bodies are unpredictable. Most of us will need some form of long-term care at some point. Nothing is more heart-breaking than to either burden our children with those expenses, or worse (depending on your point of view), go into a public facility that doesn’t provide the best care.

Pre-retirees should examine the cost of long-term care policies and resources for paying for long-term care. This needs to start early, so you have plenty of time to organize your finances to include that care.

9. Failing to maximize Social Security & Pension benefits

It’s important to know well in advance the various strategies you can employ for claiming your benefits. Should you claim all you can as early as possible? Should you postpone? How much can you earn from working and still get maximum benefits? Many strategies for maximizing your pension and security benefits are not publicized, and the difference between the best decision and the worst possible decision of when to elect … “can be well over $100,000," according to an article by the International Association of Registered Financial Consultants. Every penny counts in retirement.

10. Overspending on your kids

You’re the one who’ll soon be retiring. They’re entering their prime earning years. Let them take on the burden of financial stability. They may have to do with less. They may struggle more. But on balance, you’re both better off if you’re more financially stable in your golden years.

Owning a home early in life is one key to a financially secure retirement. If you or someone you know needs to buy their first or second HOME OR is considering buying a rental property as an investment, please contact me for real estate help.

Recent Posts