7 Cracks That Drain A Home Buyer's Money

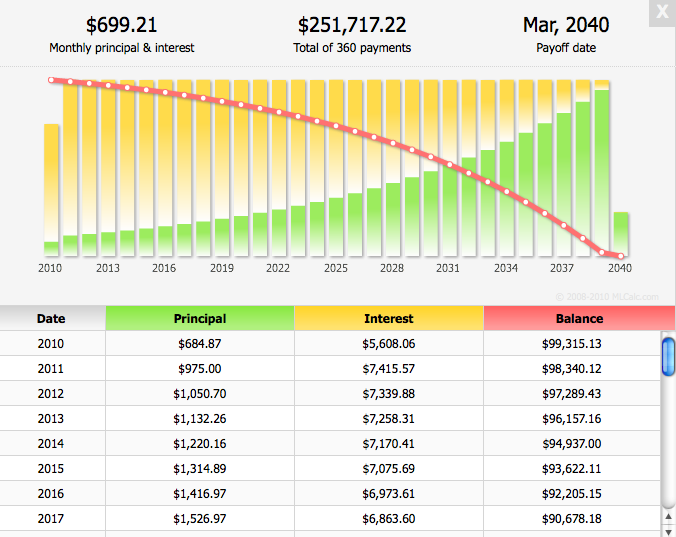

7 CRACKS THAT DRAIN A HOME BUYER’S MONEY A mortgage is the biggest financial commitment most of us will ever make. And when the numbers are that massive, it’s surprisingly easy for thousands of dollars to vanish without you noticing. Before you sign on the dotted line, watch out for these 7 snea

Spring Cleaning

Spring Home Maintenance Checklist for Indiana Homeowners If you're a homeowner in Fort Wayne or anywhere across Northeast Indiana, spring is the perfect time to give your property the attention it deserves. Whether you plan to stay for years or are thinking about selling in the near future, a sol

Do Open Houses work, or are they a waste of time?

Do open houses work, or are they a waste of time? There are good reasons to hold open houses. Yet there are reasons to skip them. Read more to evaluate your best course of action! When you hire a real estate agent to sell your home, one of the first things they'll suggest is hosting an open house

Recent Posts